The Merge

One of the most anticipated milestones in the history of cryptocurrency was "The Merge" – a final transition of the ethereum (ETH) ecosystem from its traditional proof-of-work (PoW) consensus mechanism, to proof-of-stake (PoS); a switch that could be likened to changing the engine of an aircraft mid-air without any discomfort to the passengers on board. The Merge is the final stage in a series of hard forks which sought to integrate the old Ethereum Mainnet (PoW) with the Beacon Chain (PoS).

Scalability and sustainability vs miner interest

As a mechanism which rewards miners who solve mathematical problems to propose and/or attest new blocks, the probability of mining a block and receiving block rewards through the PoW consensus algorithm is a function of relative hash power in the network. Thus, as more miners run nodes on the blockchain, the hash rate (i.e. computing power of the network) increases, meaning the next block may be mined into existence a little faster than the previous.

The difficulty regularly adjusts after every block so the block times stay relatively stable. When miners leave the network (which can happen for a variety of reasons, including a decrease in the USD value of the native coin), the difficulty decreases, meaning it becomes easier for miners to mine blocks and receive rewards. This decreased difficulty serves as an incentive for more miners to return to the network, ensuring the network remains strong and sufficiently decentralized.

A switch to PoS renders miners and the mathematical problems obsolete; as the economic stake of validators determines who gets selected and rewarded on the network. Unlike PoW, the probability of creating and/or attesting a block and maintaining security in the network is not a result of hashpower, but the result of economic value-at-loss. Validator status comes at the expense of 32 ETH staked on the blockchain. The opportunity cost, though, includes being charged a fixed amount of tokens, a fixed percentage, complete slashing of the stake and/or banning the validator from the group for the current epoch (or permanently). If a validator participates correctly more than half the time, then their rewards will be net positive. Validators accrue rewards for making blocks and attestations when it is their turn to do so.

The consensus switch to PoS had been in discussions since the early days of Ethereum in 2015, centered around sustainability because of its electricity consumption as a PoW network. Vitalik Buterin, the co-founder of Ethereum, had always been in avid support of switching the consensus mechanism to proof of stake due to it’s capacity for higher scalability, reduced issuance of new ether, lower barriers to entry leading to increased decentralization, and, most importantly, a reduced carbon footprint with lower electricity costs.

CCRI (2022) says, “The Merge reduces the electricity consumption and carbon footprint of the Ethereum network by over 99.988% and 99.992%, respectively”. Protocols and developers on the Ethereum network support this switch as it means less electricity costs, enhanced security and a substantial enhancement to the environmental sustainability of the Ethereum network.

Proof of Work

Proof of Stake

Electricity consumption

Requires large amounts of computational energy to solve for new blocks, especially when there are lots of transactions

Requires staked funds to propose or vote on new blocks. Minimal electrical power required.

Security of Usage

Expensive amount of electricity required to take over a hashrate

Malicious actors lose their staked ETH and are kicked off the network. 5X more expensive to take over a hashrate

Consensus mechanism

Requires Miners and Energy

Requires Validators and locked funds (staked ETH)

Ethereum Forks

As with all things concerning change, there are always parties left behind who will not profit from the new movement. A majority of which are miners who had no incentive to hold or own ETH besides receiving it as block rewards. This led to the creation of $ETHW (Ethereum Proof of Work), which is supported by some exchanges. It is a hard-forked chain that airdropped ETHW on a 1:1 basis to holders of ETH on the previous mainnet. ETHW launched immediately after the switch from Proof of Work to Proof of Stake as a hard fork of the Ethereum blockchain. Snapshots were taken and ETHW was airdropped.

ETHW is currently listed on major cryptocurrency exchanges such as FTX, MEXC, and Gate.io with spot and futures trading enabled, while Binance (2022) recently launched an ETHW mining pool. The Binance pool is not accepting deposits, only withdrawals. A major reason for the support from these exchanges is to support all voices within the Ethereum community and encourage potential blockchain development.

Tom Yang, the EVP at gate.io confirmed the exchange’s commitment to supporting “all voices” in the ETH community, as they believe this will foster development in the broader ecosystem. “Regardless of the path that anyone chooses, Gate.io will support and protect their choice. We expect The Merge to happen with a high probability. Potential hard forks have also gained traction, and we are providing solutions in advance for both scenarios so all parties can choose with confidence.”

Grayscale investments, the world’s largest digital asset manager has differing opinions and will be liquidating their airdrops which are an estimated 3,059,976.06309448 ETHPoW tokens over the next 180 days and distribute net cash proceeds to shareholders (GlobalNewsWire, 2022).

A notable mention here is Ethereum Classic which was the ‘original’ Ethereum chain. The current mainnet, which just completed the merge, forked away from the Ethereum Classic chain in 2016.

Major market participants priced in a successful merge event as seen with upward movements from the June lows of $981 to the local top of $1,760 and price has been on a steady decline ever since.

This was a buy the news and sell the event situation, considering the overlaying global macroeconomic conditions – rising inflation around the world, increasing energy costs, and rising interest rates in the US, which dampened the enthusiasm surrounding The Merge. ETH has drastically reduced emissions as less rewards are required for validators securing the network and a constant burn mechanism to incentivize holders for the long term. The issuance of new ETH can be monitored here (

https://ultrasound.money/

) for proper comparison against what POW emissions would have been.

The flywheel effect of this new upgrade will be seen as time goes on but for now, the capital that would be used to purchase digital assets is being diverted to stay alive in the face of market volatility.

Future-proofing DeFi or a fad?

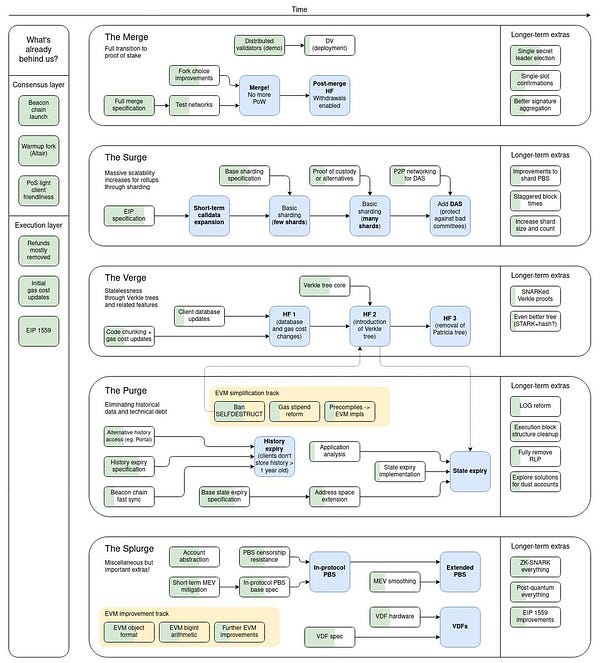

Vitalik stated at the last Ethereum Community Conference in Paris that Ethereum is only 55% done and there is still a decent amount of work, post-merge. Other planned upgrades are:

The Surge - addition of Ethereum sharding, a scaling solution which the Ethereum Foundation claims will further enable cheap layer-2 blockchains, lower the cost of rollups or bundled transactions, and make it easier for users to operate nodes to secure the Ethereum network.

The Verge - Introduction of verkel trees for data optimization.These technical upgrades will allow users to become network validators without the need to store extensive amounts of data on their machines.

The Purge - reduction of space required to store ETH on a hard drive. This will simplify the Ethereum protocol and discard the requirements of nodes to store history

The Splurge - “The other fun stuff”

The future of ETH as the backbone of decentralised finance and applications has been made even more secure with the switch to an environmentally sustainable consensus mechanism. It has also made it more expensive for malicious attackers to take over the network. Proof of Stake enables Ethereum to fight back against malicious actors, slashing the staked tokens of any attacker and sending them back to zero. It decentralises network security by enlisting individual validators - anyone with an internet connection and an ethereum balance - to stake from home and secure a portion of the network.

(Vitalik,2021) Ethereum Roadmap

Reference List

Vitalik Buterin (2021) Happy birthday beacon chain!

Here's an updated roadmap diagram for where Ethereum protocol development is at and what's coming in what order.(I'm sure this is missing a lot, as all diagrams are, but it covers a lot of the important stuff!) (via @VitalikButerin), 2 December 2021 [Twitter]. Available at

Happy birthday beacon chain! Here's an updated roadmap diagram for where Ethereum protocol development is at and what's coming in what order. (I'm sure this is missing a lot, as all diagrams are, but it covers a lot of the important stuff!)(Accessed 30 September 2022)

Medium (2022) Gate.io EVP on The Merge: Supporting crypto community’s needs is a top priority [Online], 29 August 2022. Available at https://gateio.medium.com/gate-io-evp-on-the-merge-supporting-crypto-communitys-needs-is-a-top-priority-a07d234fb5bb (Accessed 02 October 2022).

Vitalik Buterin (2022) YouTube video, added by Grand Amphi Theater [Online]. Available at Vitalik Buterin(Accessed Oct 2,2022).

Crypto Carbon Ratings Institute, (2022) September Report [Online]. Available at https://4795067.fs1.hubspotusercontent-na1.net/hubfs/4795067/CCRI-ETH-Report-2022.pdf(Accessed 30 September 2022).

GlobalNewsWire (2022) Grayscale Investments® Declares Distribution of Rights to Ethereum Proof of Work Tokens [Online] 16 September 2022. Available at https://www.globenewswire.com/en/news-release/2022/09/16/2517691/0/en/Grayscale-Investments-Declares-Distribution-of-Rights-to-Ethereum-Proof-of-Work-Tokens.html (Accessed 02 October 2022).

Binance (2022) Binance Pool Officially Launches Ethereum Proof-of-Work (ETHW) Mining Pool: Join ETHW Mining to Enjoy Zero Pool Fees! [Online], 29 September 2022. Available at https://www.binance.com/en/support/announcement/5ec076eec0cb49babae90f6b0597d5c7?ref=AZTKZ9XS&utm_source=BinanceTwitter&utm_medium=GlobalSocial&utm_campaign=GlobalSocial (Accessed 02 October 2022).